Gambling companies such as DraftKings, FanDuel, BetMGM and Caesar’s have done well for themselves over the last few years. However, today I’ll share some ideas I came up with on how these companies, collectively referred to as The House, can both diversify and increase their profits. So yes, this will be another pro-capitalism article. As always, make sure to sharpen those pitchforks!

The first step to increasing the profit margins of The House is that they need to become their own banks. This isn’t too uncommon, since this is the model that American Express already follows. The first step after becoming a bank would be to allow bettors to direct deposit their paychecks into their gaming accounts. For example, DraftKings currently accepts wire transfers as a means of funding an account, however this adds an extra step to the process, one that adds no value to either the bettor or DraftKings. Eliminating the pesky middleman-the bettors bank-would eliminate the friction. Gambling is a game of impulse, hence tearing down barriers between the bettor and The House is absolutely paramount. Frictionless transactions are higher yielding transactions, I can’t imagine a single betting executive that wouldn’t take that deal. To incentivize direct depositing paychecks, The House can offer waived fees and the occasional free bet. This isn’t a groundbreaking tactic either, Bank of America already does it, and if you think they are the only bank to do so, then I have some oceanfront property in Denver you might be interested in.

Once The House has established itself as its own bank, it absolutely needs to get into the lending business. The House can offer high interest, unsecured loans to qualified bettors. One such qualification for these loans needs to be having regular direct deposits set up with The House. Another condition to receiving funds is that the borrower must have maintained a regular betting history with The House prior to applying for the loan; this is done to filter out non-serious players. With all of that said, the unsecured lending is small potatoes compared to what the true market is; home equity lines of credit (HELOC). Under this proposed model, The House would allow their truly dedicated customers to fund their account using the equity of their home. Of course, should the bettor default, The House now becomes a homeowner, and this is where the truly profitable opportunities lie. Once enough homes have been repossessed, The House can enter into the landlord business, with a twist; discounts on rents for tenants who play regularly through The House. After all, the flywheel must keep spinning.

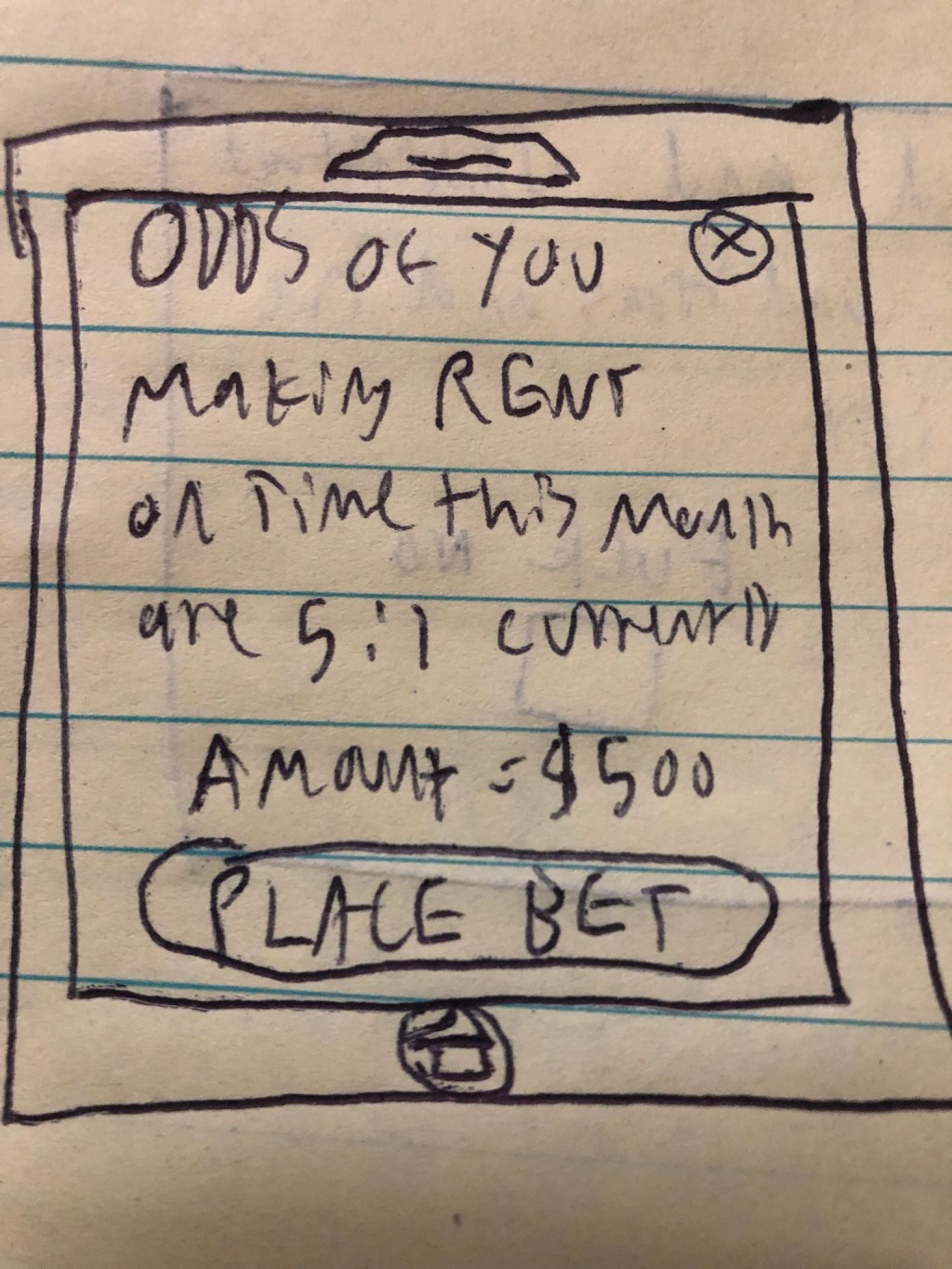

Breaking away from banking and into mobile user interface, The House can use currently existing technology to enable push notifications and banners while ardent users are perusing through their phones, doubly so while they use the banking or housing portals of The House. The House can trend real estate data (or, use the agreed upon lease if the bettor is a tenant, as described in the last paragraph) and flash a banner that states Make Rent This Month: Bet $50 on [insert 30:1 underdog here], with a link that would lead the bettor to easily place a wager on that game. This idea can be scaled up or down to fit a variety of situations; banners such as Feed Your Family This Month: Bet $50 on [insert 10:1 underdog here], while using some solid estimate tools for grocery prices in a given area. A scaled-up version of the idea would be Cover Your Children’s In-State Tuition: Bet $400 on [insert 25:1 underdog here].

Of course, the proliferation of The House could not be possible without the gold standard; government getting out of the way. Specifically, the archaic Professional and Amateur Sports Protection Act was struck down in 2018 by the Supreme Court, thus ushering in a freer society for us all. Exact figures are hard to come by, since the industry is constantly expanding, though suffice it to say that we’ve bet far more than the GDP of some nations since the feds stopped meddling in the financial affairs of Americans.

When it comes to stifling government regulation versus the innovative private sector, I’ll bet on the latter any day…