Mr. Krabs is the founder and owner of the Krusty Krab, a fictional burger restaurant depicted in the show SpongeBob SquarePants. Mr. Krabs is often depicted negatively on the show, and real-life online discourse isn’t very charitable either. However, I’m a fan of capitalism and I’d like to go over why Mr. Krabs would be a great venture capitalist, contrary to the reductionism that the 75 IQ crowd typically treats the crustacean entrepreneur with. Given that this will be another pro-capitalism article, I fully expect some sharpened pitchforks, just make sure to forgo the butter sauce.

Before one can start placing YOLO bets, one needs money to invest. Excluding those born into wealth, this means that to become a full-time investor, one must become wildly financially successful via becoming a great founder and/or CEO prior to full-time investing. There is no shame in that, after all, even the GOAT had to start there. The show’s source material contradicts itself wildly as to the origin story of the restaurant, however they all agree on the fact that Mr. Krabs boot-strapped his company and grew it into a profitable venture. Given that the average profit margin in Krabs’ line of work is only about 5%, Krabs clearly runs a tight ship, which speaks volumes to his operational prowess. More impressively, Mr. Krabs did this without taking outsider money. Very few businesses in the food and beverage industry, real or fictional. can manage this; Gary Erickson is a legend for pulling it off for so long. Clearly, Mr. Krabs is no fool; he’s earned his status as an accredited investor (even though that concept is a sham).

Besides building a profitable venture, a founder who is hoping to transition to venture capitalism needs to be liquid as well. After all, merely just having a high net worth means little if it you cannot pounce on opportunities. Elon was so illiquid that he needed to sell shares of Tesla and get some help from his wealthy amigos to fund his purchase of Twitter. However, Mr. Krabs is rarely shown to have a liquidity crisis. Mr. Krabs is often portrayed sleeping on money, singing to it, and generally playing with stacks of currency like he’s mid-career Floyd Mayweather. With all of that cash lying around, Mr. Krabs is in a good spot to go into venture capitalism.

So now that we’ve established that Mr. Krabs has both the net worth and the liquidity to merit a seat at the table, let’s talk about his mindset. Mr. Krabs’ most illuminating feature is that he likes money (which, to clarify, is NOT a bad thing). He’ll need this motivation, as it will help him sift out the often-ineffective visionaries from the actually profitable CEO’s. Mr. Krabs has shown the willingness to step in and run a tighter ship at his business when needed, and the need for this will come in often as start-ups have a high failure rate. There are times when ousting the founder and the VC steering the ship becomes necessary, and given all of the evidence from the show, Mr. Krabs would be certainly willing to get his hands (claws?) dirty from a day-to-day aspect.

The vision of the founders is one thing, but the tactics of a business also should not be overlooked. Warren Buffet is famous for delving into his theory on competitive moats. Mr. Krabs has shown a thorough understanding of this concept, as much of his success is built on the secret recipe for his restaurant’s signature dish. On a related note, Mr. Krabs also understands the importance and the nitty-gritty of safeguarding intellectual property. His chief competitor, Plankton, has attempted corporate espionage numerous times to no avail. Needless to say, Mr. Krabs will not be buying into a fidget spinner start-up, funding an invention with no IP protections, or buying into ventures with haphazard security measures in place.

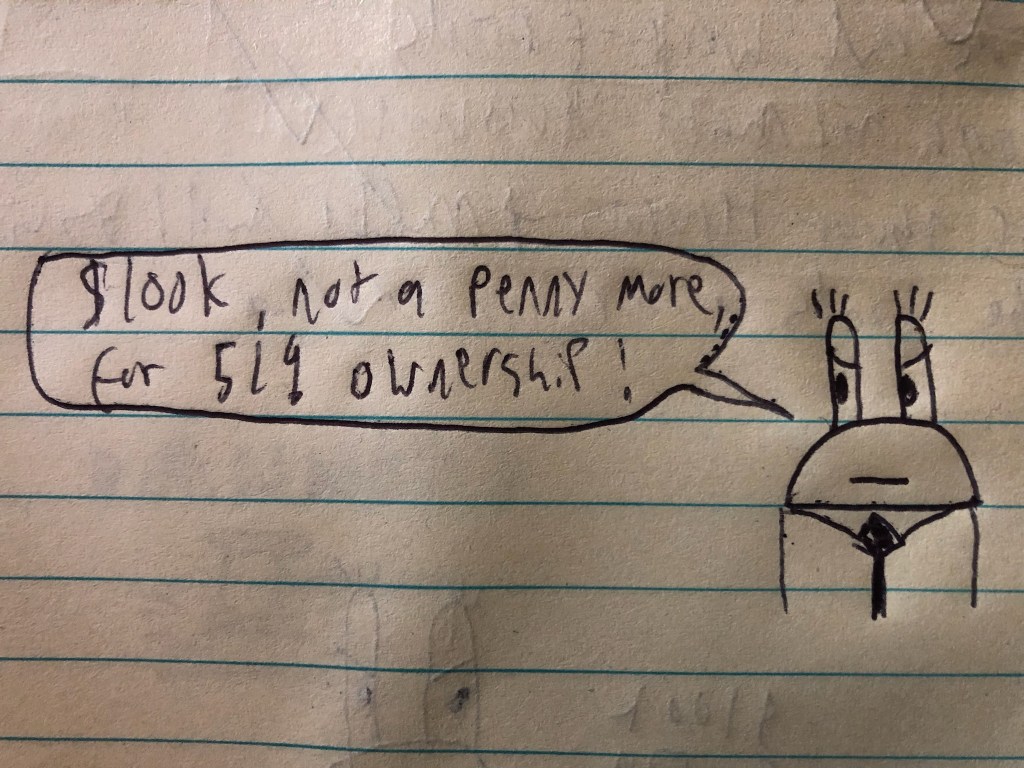

Mr. Krabs also understands risk pretty well, and yet is unafraid of entering into new markets. This was displayed in one early episode of the series as he attempted to enter into the pizza and delivery space with the unveiling of the Krusty Krab Pizza. There was a wide untapped market in the small fictional town of Bikini Bottom, and Mr. Krabs was eager to garner up some market share. He was even willing to enter into the lucrative private prison market in order to expand his portfolio. This willingness to foray into waters previously uncharted to him will serve Mr. Krabs well as a venture capitalist.

Lastly, Krab’s has shown to be a shrewd networker. Many companies that receive VC funding do so because they were introduced to investors through informal channels; work friends, former employees, close associates, et cetera. Mr. Krabs has shown to be well-known in his community, thus showing a level of social savvy that would likely open doors for him to new investment opportunities that would be closed off otherwise.

Shark Tank could get a little more interesting with a literal oceanic predator on the panel…