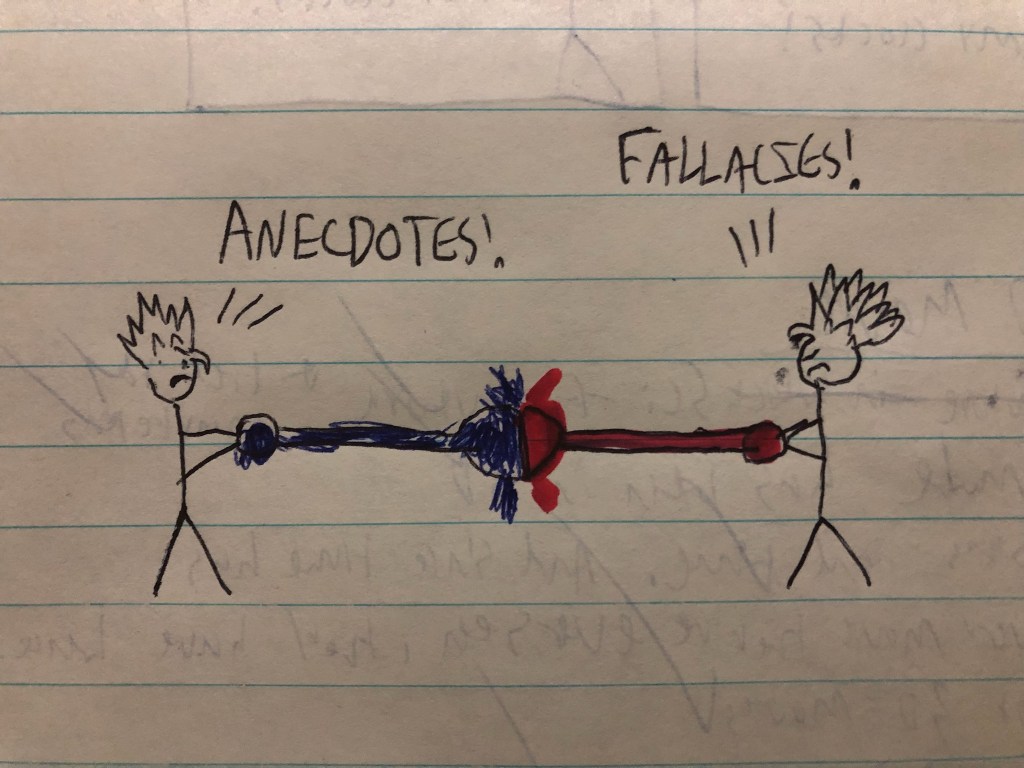

Earlier today I was on my trusty stationary bike as I was training for my new fitness goal, when I heard an interesting exchange in the podcast I was listening to. The host and his guest were talking about the question What makes a good life? Then the comparison of ideologies between the billionaire founder of Rocket Mortgage and frequent LeBron James break-up victim, Dan Gilbert, versus the Nobel Prize winner and author of Thinking, Fast and Slow, Daniel Kahneman. The answer to the grand question suddenly became unimportant to me. Instead, what became important to me was the question it represented; who should we listen to and why; billionaires or Nobel Prize winners? The question instantly formed an ideological Dragon Ball Z-style beam struggle.

Now of course, there are many of you already sharpening your pitchforks, crying out “Dan, it’s a no-brainer that we should listen to respected scientists!”. However, I am here to say that the reality of this question is that it has more going on than meets the eye. “But Dan, shouldn’t we only respect scientists who have won a Nobel Prize?” an inattentive reader will ask. No, that’s absurd and is truly a 75-IQ quip. Keep sharpening those pitchforks, though!

Firstly, we need to take a deeper dive into Daniel Kahneman’s expertise. Thinking Fast and Slow is a book that focuses on the two-tiered processing speeds of our brains; one is for making snap decisions that require immediate action (such as ducking to avoid a projectile), and the other for complex problems that require more rumination but are not immediate threats (such as whether or not to buy a house). Kahneman is also one of the pillars of the relatively young field of behavioral economics, and hence was awarded the Nobel Prize in Economics for his work in evaluating “human judgement and decision-making under uncertainty” in 2002.

However, expertise does have its limits, and that includes Kahneman. Just because he is an expert in decision-making despite not having all of the information (hint: we rarely, if ever, have all of the information), that does not make him an expert in the realm of happiness. In fact, it is rare for someone to be an expert or a top 1% performer in the world in more than one endeavor. This is due to the amount of time it takes to do so is simply too grand for our depressively short lives. Kahneman isn’t an expert in happiness, plain-and-simple. Therefore, we should take his advice with a grain of salt when it comes to that topic, or any topic that isn’t in his narrow field of expertise. Besides, the reasoning of He has a Nobel Prize, so he has to be right is simply a textbook example of the appeal to authority fallacy. The failure to recognize the appeal to authority fallacy has had severe consequences in the past. Prosecutors in the U.K. used it to convict Sally Clark to life in prison in the late 90’s, however, the expert witness was a medical doctor and not a statistician. It also turns out that he didn’t even perform the calculation correctly either; it looks like Dr. Dahle was right when he said that doctors still need to go to math class.

Now that I’ve scrutinized one side of this metaphorical Dragon Ball Z beam struggle, we need to look at the other side: billionaires. Truthfully, it’s enticing to listen to billionaires, I’m guilty as charged. Regardless of what industry that they are in, every self-made (i.e., non-inheritance) billionaire clearly understands market niches, scaling a business, pricing models, business leadership, currency conversions, inflation, and several other topics related to finance. After all, that is what made them billionaires to begin with. Want proof? Steve Wozniak was one of the original founding members of Apple though his net worth is peanuts when compared to the much more famous Steve that co-founded Apple. Wozniak was content to be an engineer (which to be clear, there is nothing wrong with that) while Jobs was the one viciously trying to seize the market. Billionaires have this core knowledge in addition to their specific industry, whether it is Da Zuck when it comes to website design and data science or Bezos when it comes to retailing, and so on.

To go back to the original podcast question regarding happiness; Daniel Gilbert is more likely (note that phrasing) to have a clearer understanding of happiness than Daniel Kahneman for a seemingly all-important reason; opportunity. Gilbert’s net worth affords him access to experiences that mere mortals are locked out from. Any wild adventure, travel destination, exotic food or other luxury trinket is easily within Gilbert’s grasp, while Kahneman could only stand back and be amazed at such a lifestyle. Gilbert, and nearly any billionaire that doesn’t live like a Tibetan monk, can give crisply first-hand insights on the topics of happiness and how much is enough via their lived experiences.

However, there is a shortfall with that as well. As anyone who aced science class can attest, there is a world of difference between a single anecdote and population-level data. One data point, even if that one data point is a billionaire, isn’t enough to justify population-level statements, nor should it be used to make life or policy decisions with. Anybody who says we have to factor in sampling bias as well gets extra credit; billionaires are not representative samples in the realm of the human experience, so the data they would provide is likely to be heavily skewed. My most attentive students will realize that the last two sentences I’ve conflated anecdotes with data, and they are not the same thing; I’m glad you caught that!

Ultimately, neither Gilbert nor Kahneman can speak as an authority on the stated topic. Admittedly, the idea of a billionaire versus Nobel Prize winner was enticing at first, however I realized that it isn’t relevant who would win the metaphorical Dragon Ball Z beam struggle. Instead, it was actually an opportunity to watch carefully and fine-tune our bullshit detectors. This is because while I enjoyed the podcast episode (and the overall body of work from Mr. Williamson), the presentation of which sage’s wisdom to follow was misleading, even if it was unintentional.

You have a Bullshit Detector installed between your ears; make sure you use it…